Welcome to edition 14 of Metric Stack Newsletter! I’m Priyaanka Arora, your personal metric assistant and content researcher and writer at Klipfolio. This week, I’ll take you on a deepdive of Burn Rate.

Considered one of the fundamental metrics to measure cash runway, Burn Rate is popular especially with startups looking to manage expenditure and improve operating efficiency. Tracking Burn Rate is your first step towards being the master of your money. With benchmarks to guide us, we’ll get a robust picture of what your Burn Rate should look like. Let’s get started!

What is Burn Rate?

Burn Rate measures the rate at which your business burns through capital in order to generate revenue. It is usually expressed as Net Burn. Net burn mainly consists of gross profit subtracted from operating expenses such as admin costs, sales and marketing spend, and R&D. Here’s the formula:

Net Burn = Operating Expenses - Gross Profit

As a refresher, gross profit is calculated as the difference between Revenue and Cost of Goods Sold (COGS).

What’s the difference between Net Burn and Gross Burn?

As I mentioned above, Burn Rate refers to net burn, expressed as a dollar amount burned every fixed period (monthly for SaaS businesses).

Check out this comparison page for a quick understanding of the difference between Net Burn and Gross Burn. Essentially, net burn measures burn rate by subtracting gross profit from Operating Expenses, giving you negative cash flow. Whereas, gross burn is simply the sum of various operating costs including COGS, salaries and overhead, depreciation and amortization, interest and taxes, and other operating costs.

It’s important to know the difference between net burn and gross burn because the two terms are often incorrectly interchanged. But let me make it clear: burn rate refers only to net burn which is negative cash flow. This essentially means if your net burn is a negative number, you’re adding to your cash runway.

How to calculate Burn Rate

Let’s look at two examples of how to calculate Burn Rate.

In the first scenario, assume your business has monthly operating expenses adding up to $500K and a gross profit of $300K. Your Burn Rate is $200K, which is the amount of capital you are burning each month.

In the second scenario, your monthly operating expenses add up to the same $500K as before, but your gross profit for the month is $600K. In this case, your Burn Rate would be -$100K, which actually indicates positive cash flow. To put it in very simple terms, you’re burning negative money, i.e. adding money to your cash reserves.

What’s a good Burn Rate benchmark?

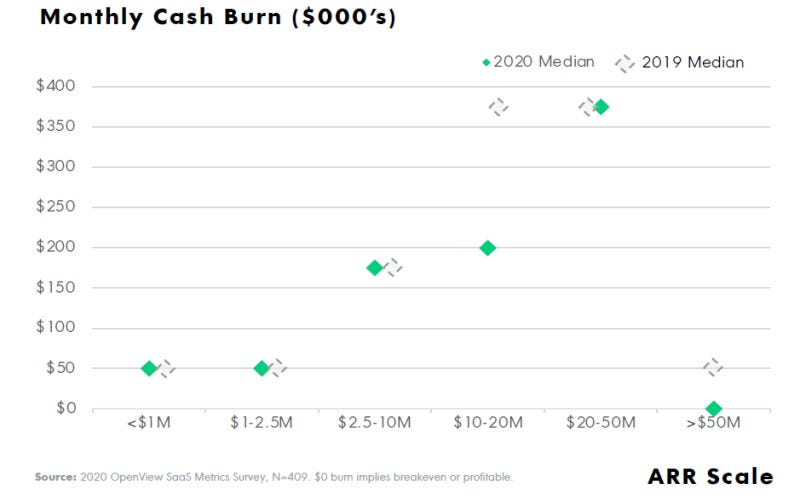

According to OpenView’s 2020 SaaS benchmark study, monthly cash burn is around $50K for companies with less than $2.5M ARR scale, between $150K and $200K for companies with slightly higher ARR scale, and $350K for companies ranging between $20M and $50M ARR scale. Interestingly, monthly cash burn drops to 0, or breakeven, for companies with greater than $50M ARR scale.

What does Burn Rate tell you about your business?

At the surface, Burn Rate tells you how fast you’re burning through your cash reserves. Too much burn obviously means that you’ll eventually run out of cash, which is why it’s so crucial to regularly track your metrics.

What Burn Rate really gives you is an indicator of your operating efficiency. How much of your operating expense is converting to growth for your business? The funny thing about chasing growth is that startups often spend excessively to acquire new customers and lose track of net burn. I covered why CAC is the startup killer way back in edition 5 of Metric Stack. Tracking Burn Rate is your first step towards controlling your costs and becoming the master of your money.

Metric Stack hit 1K subscribers: join the celebration!

I’m beyond thrilled to announce that Metric Stack Newsletter has passed the 1K subscriber mark! It means so much to me that more than a thousand people want to read what I have to say. This couldn’t have happened without the readers of Metric Stack, so I want to show my gratitude by celebrating!

Stay tuned for exclusive content just for the subscribers of Metric Stack. And if you know someone in your network who would love to join the celebration and learn more about how to use metrics to run a successful business, all they need to do is subscribe to Metric Stack Newsletter!

Stay tuned for the next edition of Metric Stack Newsletter to get the latest scoop on all things metrics! Send feedback, comments, questions here: parora@klipfolio.com