Customer Churn vs Revenue Churn

Metric Stack 15: Logo Churn and more!

Welcome to week 15 of the Metric Stack Newsletter! I’m Priyaanka Arora, your personal metric assistant and content researcher & writer at Klipfolio. I want to start this edition with a question for you to think about.

Is churn a financial metric or a customer success metric?

Multiple metrics look at churn in so many different ways. There’s logo churn, MRR churn, net dollar retention, negative churn, and the list goes on! While the most obvious answer to my question above is that churn can be both a financial and customer success metric, I want to revisit that assumption today. Let’s start with the basics first:

What is Logo Churn?

Logo Churn, also known as Customer Churn, is the percentage of customers who unsubscribe from a service within a fixed period of time. Here’s the formula:

Logo Churn = Churned customers this period / Total customers at the beginning of the period

The basic churn equation states that in order for your customer base to grow, the number of new customers must exceed the number of churned customers.

Another metric that looks at churn is Net MRR Churn Rate. This metric subtracts expansion revenue from downgraded or cancelled MRR and divides the result by total MRR at the beginning of the period.

Together, Logo Churn and Net MRR Churn Rate give you extremely useful information: how much money is leaving your business, and to what extent is your customer base shrinking?

The problem arises when you wonder which metric to prioritize when tackling churn. I have one possible solution for you that I’d like to share today, but before that, let’s look at some benchmarks:

What is a good Logo Churn benchmark?

According to a study by OpenView, the monthly Logo Churn rate is between 3-7% for SMB markets and 1-2% for mid-market.

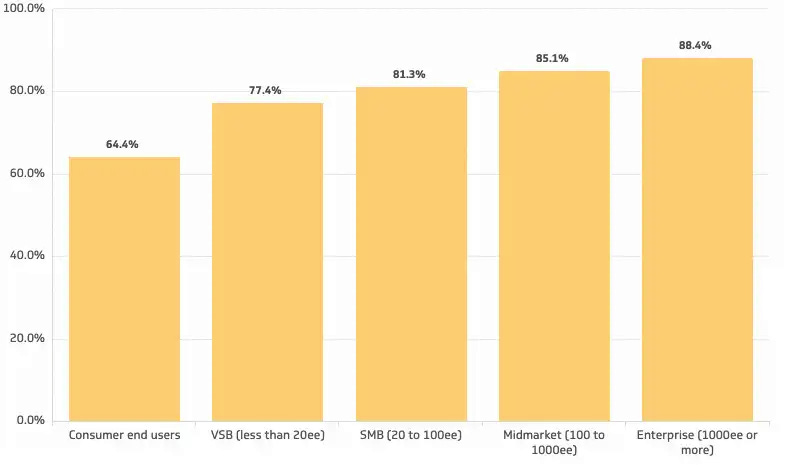

The chart shows annual customer retention rates by target customer type. As you can see, retention increases - therefore decreasing churn - with increased size of target customers. This benchmark is only a guideline to objectively classify what can be considered a “good” churn rate.

In reality, churn is very rarely a good thing. What you take away from high churn rates depends on how you are looking at churn. Do you look at customer churn or revenue churn? Which metric should you prioritize when trying to decrease churn?

Customer churn vs revenue churn: which is better?

I argue that it’s better to track customer churn, because churn performs better as a customer success metric and not as a financial health metric. Hear me out.

If revenue churn is your primary churn metric, you’ll be tempted to segment MRR churn into high paying products or services that take the biggest chunk of revenue. You might feel that it’s acceptable or even intentional when low paying or freemium customers churn because you only see a small percentage of revenue churn as a result. You may even be trying to introduce a new product or transition your existing customer base to a new product.

The bottom line is that looking at revenue churn leaves you dangerously clueless about why your customers are leaving or whether you have a customer churn problem. How do you know if you’ve crossed the threshold of expected customer churn if you’re only following revenue flow?

I’m not trying to say that you should completely ignore revenue churn. However, it is more useful to track customer churn as your primary churn metric.

This is mostly because you have other metrics to track revenue, such as NRR Rate and net ARR added, but how many metrics can you think of that measure customer flow? And before you say CAC or LTV, those count as revenue metrics as well. This brings me to my key argument for the best metric to track churn:

Churn is a primarily customer success metric rather than a financial performance metric.

If you have a customer churn problem but you're convinced you'll upsell to recover the costs, you're not alone in your thinking. We've established that acquisition is not the answer to churn or the path to revenue growth - read more about why CAC is the startup killer and why expansion revenue equals symbiosis - but is expansion? This article goes in depth on why you can't offset customer churn with upsells, but in essence, churn is a symptom of mainly two things:

poor customer fit and

poor customer experience

If you have a customer churn problem, i.e. more churn than the normal range for your business and industry, you're not likely to solve it by trying to sell customers more of what didn't work for them.

Instead, address churn as part of your customer success journey to enable happy customers, increase loyalty, and increase growth for your business.

Metric Stack hit 1K subscribers: join the celebration!

I’m beyond thrilled to announce that Metric Stack Newsletter has passed the 1K subscriber mark! It means so much to me that more than a thousand people want to read what I have to say. This couldn’t have happened without the readers of Metric Stack, so I want to show my gratitude by celebrating!

Stay tuned for exclusive content just for the subscribers of Metric Stack. And if you know someone in your network who would love to join the celebration and learn more about how to use metrics to run a successful business, all they need to do is subscribe to Metric Stack Newsletter!

Stay tuned for the next edition of Metric Stack Newsletter to get the latest scoop on all things metrics! Send feedback, comments, questions here: parora@klipfolio.com